VAT

If your farm is VAT Registered calculating the amounts of

VAT to pay and amounts to reclaim can be a very time consuming task. FarmIT 3000 will track

all your VAT transactions and calculate your VAT return figures (VAT 100) for your

VAT return at the click of a button.

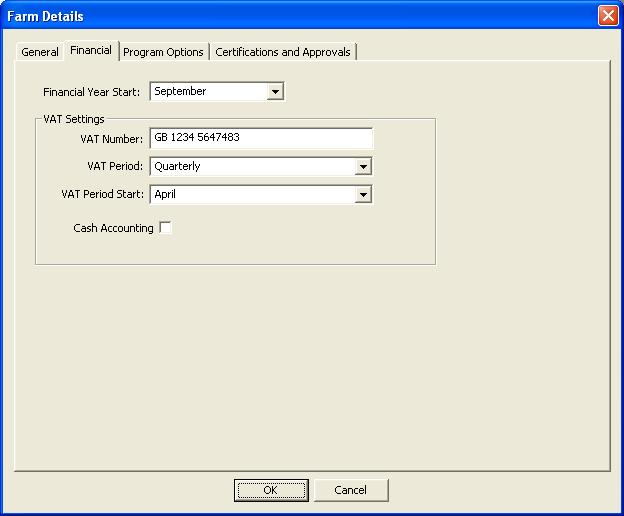

First to ensure that the system records VAT you must enter your VAT number on

the Farm details financial tab.

You may also specify the vat period, for example quarterly or monthly and the

starting month for the period if quarterly or yearly. This information is then

used when you select the date periods such as 'This VAT Period' or 'Last VAT

Period'.

If you choose

invoice accounting you are liable to pay the VAT on an invoice you generate,

based on the invoice date. Similarly you may reclaim the VAT on a bill you

receive based on the bills date.

Therefore

your VAT 100 report (VAT

return) includes all invoices

and bills for the period irrespective of whether you have been paid by the

customer or you have paid the bill.

If you choose

cash accounting you are liable to pay the VAT on an invoice you generate only

when the customer pays you. The VAT date is based on the date you receive the

payment. Similarly you may reclaim the VAT on bills only after you have paid

them and based on the date you payment.

Therefore your VAT 100 report will list only invoices

you have received payment for and bills you have paid. You are not liable to pay

VAT on invoices which have not been paid.

See Also

VAT Reports

Tax Codes