FarmIT 3000 - VAT Report

Farm IT Help - VAT Reports

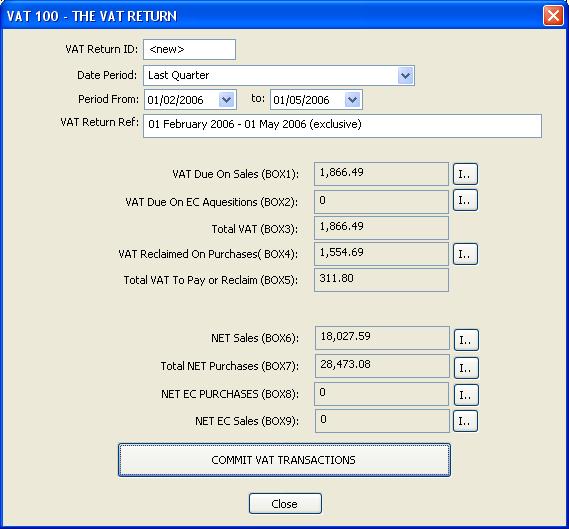

The VAT 100 Reports is designed

to allow you to easily complete your VAT 100 Form (VAT Return) for a selected

period. To create a new VAT return select the ‘New VAT Return’

option from the ‘Bank’ menu.

When the form opens the system

will initially check if you have any unclaimed (uncommitted)

VAT Transactions in the system who's effective VAT Date is before the period

start date. You will then be prompted to select any of these transactions

in the current VAT report. You may also select the transactions and clear then

so they now longer get displayed. Normally you will not have any such

transactions however if you receive a bill late it may have a date relating to a

previous VAT period, If you already claimed the period we need to carry forward

the unclaimed VAT into the next return.

When you complete your VAT return

you need to ‘Commit’ the VAT transactions. This

records the Transactions with the VAT return reference (simply the dates of the

return) and ensures that transaction are only included in a VAT return once, and

that any unclaimed transactions entered after the VAT return has been committed

are carried forward to the next VAT return if the date is before the start date

of the selected period.

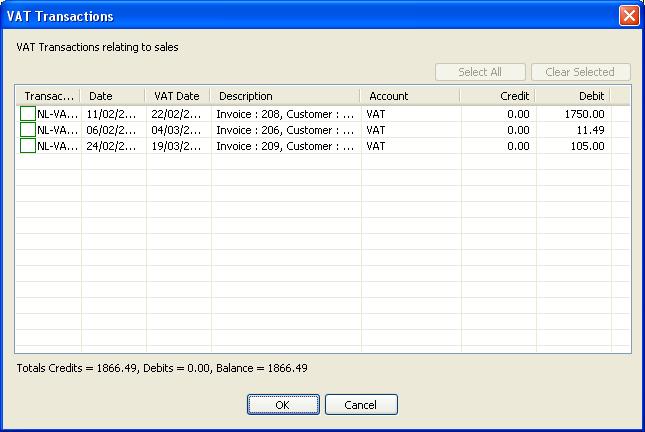

You may see exactly what

transactions make up the calculated amounts by

'clicking' the 'I..'

Buttons

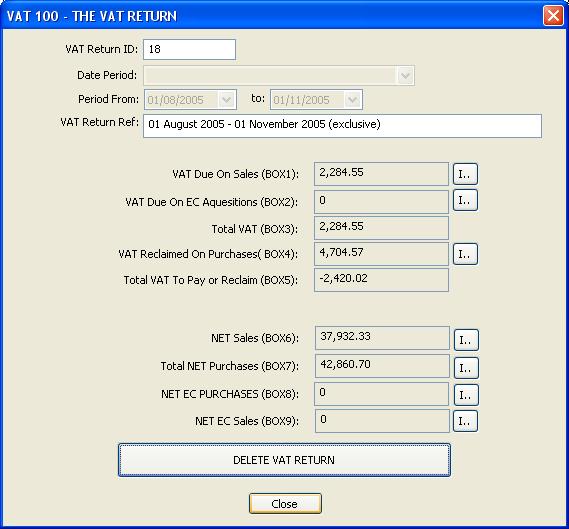

Once the VAT Return has been

commited you have a record of exactly how each VAT return looked when you

completed the VAT return form.

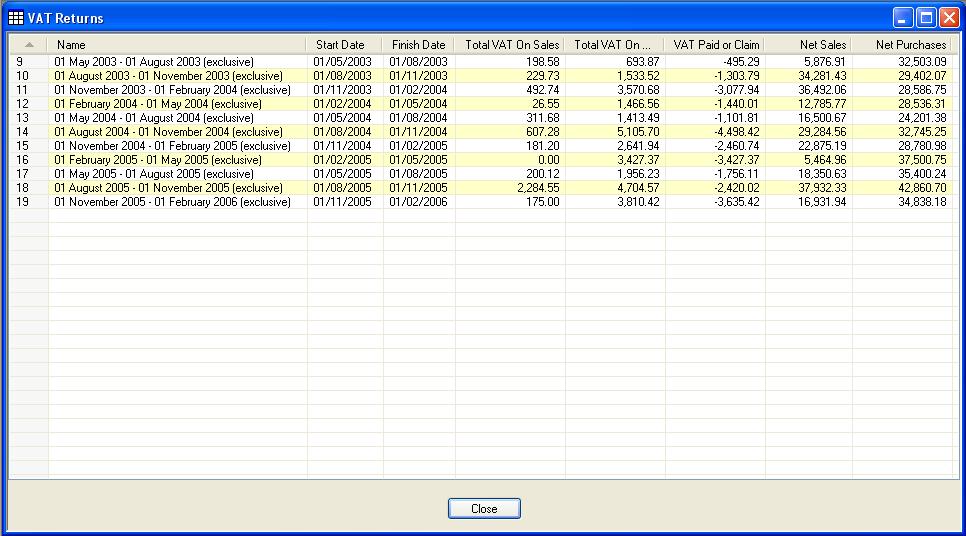

You may list historical VAT

returns by selecting the ‘List VAT Returns’ option from the

‘Bank’ Menu.

You may double click on any entry to open the VAT

return.

You may then delete the VAT 100 Record by ‘clicking ‘

the ‘DELETE VAT RETURN’ button. The VAT 100 record will be deleted

and all transactions reset to unclaimed.