VAT Tax Codes

If you are VAT registered everything you sell or buy will

have a VAT tax code. These will vary depending on the item involved. You will

need to define the VAT tax codes you will be using in the system. By default we

include two: T0 - no VAT & T1 VAT charged at 17.5%. But you may modify these

or add your own. You will be prompted to select the appropriate tax code when adding

an item to an invoice or bill.

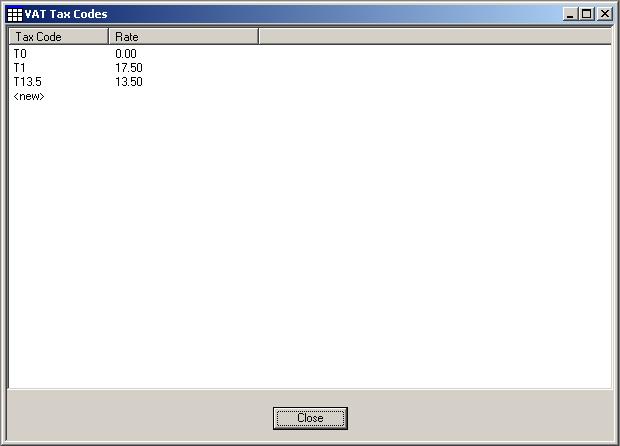

To see a list of VAT tax codes already entered or to add a new code

click on VAT Tax Codes' on the 'Farm' menu.

This will bring up your list of existing System Units.

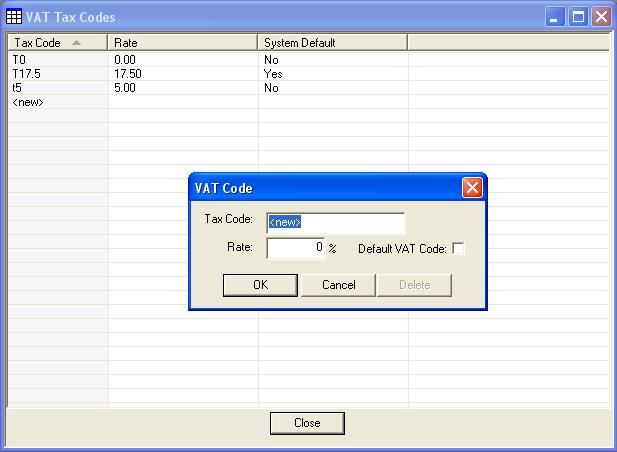

You can enter a new tax code by double clicking on '<new>' at the

bottom of the list.

Fill in the appropriate details and click 'OK' for those details to be added to the

list of VAT tax codes. This new entry will appear at the bottom of the list.

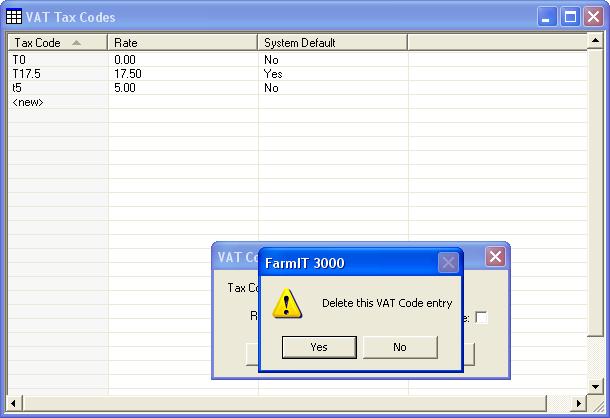

To delete a tax code double click on the code to be deleted from the list. Then click on

the 'Delete' button at the bottom of the form.

Click 'Yes' on the resulting dialog box if you are sure you want to delete the selected

tax code. Click 'No' and 'Cancel' to return to the VAT Tax Code list

with altering it.

You can modify an entry by double clicking it in the

list and altering the details before clicking OK. The modified details will then appear

in the list.