Bank Account Reconciliation

Bank reconciliation involves checking that your bank transactions match the transactions shown on your bank statement. As you pay bills, write cheques or receive payments you specify to which bank account the funds are either deposited into or removed from. These transactions are recorded in the Nominal Ledger and have a status that reflects the fact that they have not been checked against the bank statement.

Reconciling the bank account is actually one of the most important tastes in accounting. It is important for the following reasons.

1. It ensures that any bank transactions or charges are added to the system.

2. It provides a check upon whether moneys have been deposited correctly.

3. It provides tracking of the presentation of cheques and therefore outstanding liabilities.

You may also use this view to generate a bank statement that you may check against you real statement.

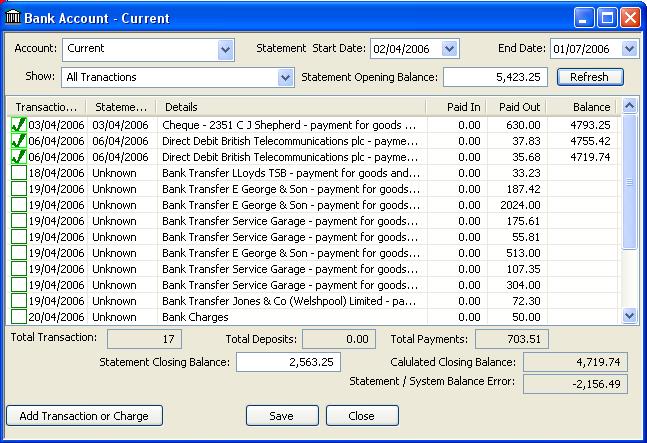

Selecting the 'Reconcile' option from the 'Banking' menu displays the current unchecked transactions from the default 'Current' account. If you wish to reconcile a different bank account, select the account from the list at the top of the form.

You may view all un-checked items by click the 'Show All unreconciled transactions', otherwise the screen displays all transactions between the dates shown. To reconcile the bank statement, verify that the transaction appears on your bank statement and simply click the green box. You will be prompted to enter the date that the transaction appears on you bank account (the dated often differ).

If you wish to check the closing balance for the statement, enter the statement opening balance and statement closing balance as shown on your bank statement. Then hit the 'Refresh' button, the calculated closing balance is then displayed and the Statement/System balance error calculated. Wjen the statement is reconciled compleatly this error should be zero. A error is the sum of the missing or unreconciled transactions.

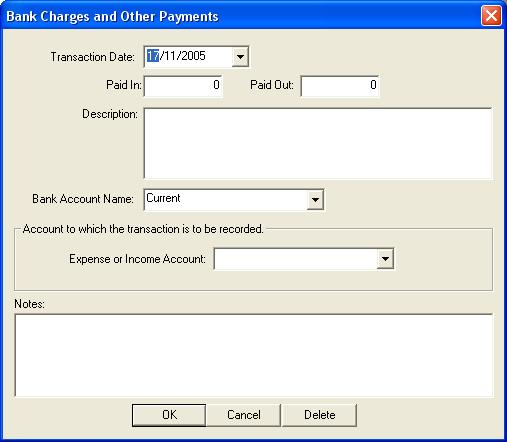

This is also a good place to add bank charges and other transaction that appear on your bank statement, simply click the 'Add Transaction or Charge' button found at the bottom left of the form. This will bring up the following window.

Complete the details of the transaction, remembering to choose which account the money has been paid into or withdrawn from. Click 'OK' to add this transaction to the list.

Finally click the 'Save' button on the main list to record all the transactions.